Imagine for a moment, if you will, the daily rhythm of life, where managing your money plays a rather central part. For millions of people, a financial institution like Chase steps in to offer a wide array of helpful products and services. It’s a bit like having a reliable partner in your corner, someone there to support your financial comings and goings. Whether you are looking to simply keep an eye on your funds or perhaps make a payment, the aim is to make these everyday tasks feel less like chores and more like simple actions. This support, you see, is meant to help you stay on top of your money matters with a good deal of ease and security.

What does it mean to have your finances at your fingertips? Well, it means having the freedom to check things whenever you need to, from pretty much anywhere you happen to be. Online tools, like those provided by Chase, let you look at what’s happening with your money, review past statements, and keep track of all your activity. It is that kind of access that can really make a difference in how you feel about handling your funds. This way, you can pay bills or move money around safely, all from one spot, which is a very convenient arrangement, wouldn't you say?

This idea of "chasing" after your financial goals, or even just keeping up with your daily spending, is something many of us do. It is a constant, quiet pursuit. And just like any pursuit, having the right tools can make all the difference. We are going to explore how some of these tools work, and perhaps, how they might fit into the life of someone like Anela Rolison, someone who wants to manage their money effectively and also appreciate the unexpected pursuits life sometimes offers.

- Maximo Garcia Wikipedia

- Caitlin Hale

- Ninalin Ninalin1231 Latest

- Alana Stewart

- How Did Alison Botha Survive

Table of Contents

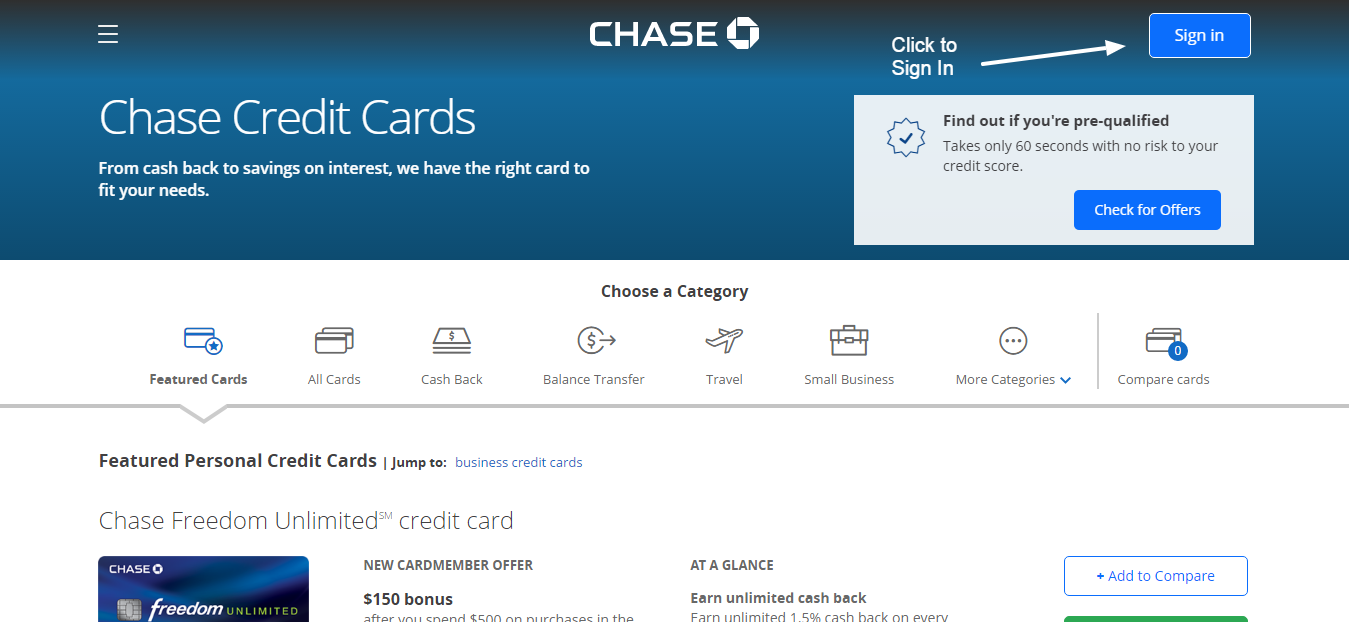

- Discovering What's Possible with Chase

- How Does Online Banking Help Your Everyday Life, Chase Anela Rolison?

- What Makes Secure Banking a Good Choice for Chase Anela Rolison?

- Finding Help When You Need It, Chase Anela Rolison

- Which Checking Account Might Suit Chase Anela Rolison Best?

- The Mobile App and Your Money, Chase Anela Rolison

- Paying Bills and Sending Funds with Ease, Chase Anela Rolison

- When Life Throws You a Curveball - Unexpected Chases

How Does Online Banking Help Your Everyday Life, Chase Anela Rolison?

So, let's talk about the practical side of things. When you are looking to manage your money, having simple, direct ways to get things done is pretty important. Think about paying bills, for instance. With online banking, you can sign in to your account through a computer or even a mobile device. It is a straightforward process, really. You just find the option for paying bills, and then you can choose to set up a payment. This means you can pick who you want to pay, decide how much money to send, and choose which account the money comes from. It is a very direct way to handle those regular payments without much fuss, which can be a real time-saver for someone like you, Anela Rolison, with a busy schedule.

The core idea here is making financial tasks feel less complicated. Instead of writing out checks or dealing with postage, you are just a few clicks away from getting things done. This approach to managing your funds is about putting you in control, giving you a clear view of your financial picture. It is about simplifying the routine so you have more time for other things. That kind of ease, you know, can really help lighten the load of daily responsibilities. It is a simple way to keep your money moving where it needs to go, when it needs to go there.

Moreover, the ability to monitor your activity means you are always aware of what is happening with your funds. You can see transactions as they occur, which helps you stay on budget and spot anything unusual. This constant visibility is a calming influence, allowing you to feel more secure about your financial standing. It’s a helpful feature for anyone who wants to keep a close watch on their spending and deposits, ensuring everything is as it should be.

What Makes Secure Banking a Good Choice for Chase Anela Rolison?

When it comes to your primary banking account, feeling safe and secure with your money is, quite naturally, a top priority. Chase Secure Banking is a type of checking account that is designed with this sense of safety in mind. One of the really appealing aspects of it is that it comes with no overdraft fees. This means you don't have to worry about extra charges if you accidentally spend a little more than you have in your account. That can be a huge relief, honestly, for many people who might sometimes miscalculate their balance. It offers a kind of financial cushion, if you will, for those small slips.

Beyond that, this account also aims to keep fees low on most of your everyday transactions. So, things like using your debit card or making transfers usually won't come with additional costs. This makes managing your daily money flow a lot more predictable and less expensive over time. For someone like Anela Rolison, who might appreciate clarity and straightforwardness in her financial tools, this kind of account structure could be a very good fit. It simplifies the cost structure, making it easier to understand exactly what you are paying for, which is practically nothing for the common things you do.

The aim with secure banking is to provide a reliable foundation for your money. It is about offering peace of mind, knowing that your funds are handled with care and that unexpected charges are largely avoided. This sort of account is built to support your regular financial activities without adding layers of complexity or hidden costs. It is about creating a dependable space for your earnings and spendings, allowing you to focus on your life without constant financial worries.

Finding Help When You Need It, Chase Anela Rolison

Even with the most user-friendly systems, questions can pop up, or you might need a little extra help with something. That is just a part of life, isn't it? When those moments arise, having easy access to customer service is incredibly valuable. Chase understands this, and they have ways for you to get the support you might need. The goal is to help you find answers to your questions without a lot of difficulty. So, if something is unclear or you are facing a problem, there are people ready to assist you.

Think of it like this: you are not alone in managing your money. There is a team available to guide you through any issues or to simply explain how something works. This support system is there to make sure your banking experience feels smooth and supported. It is about getting you the information you need, when you need it, so you can continue with your day feeling confident about your financial arrangements. This kind of readily available assistance is quite important for anyone, including someone who might be new to certain banking features, like Anela Rolison.

The idea is to resolve your queries quickly and efficiently. Whether it is a question about a transaction, setting up a new service, or just needing a bit of clarification, the customer service channels are there to provide clear and helpful responses. It is all part of making sure your relationship with your bank feels like a true partnership, where help is always within reach. This commitment to service really helps to build a sense of trust and reliability, which is a very comforting thing when it comes to your money.

Which Checking Account Might Suit Chase Anela Rolison Best?

Choosing the right checking account is a pretty personal decision, as what works well for one person might not be the ideal fit for another. When you are looking into your options, it is helpful to learn about the different benefits each type of account offers. For example, some accounts might be better if you tend to keep a higher balance, while others might be more suitable for managing everyday spending with fewer fees. It is about finding that sweet spot that aligns with your financial habits and goals.

Online, you can easily compare the various checking accounts available. This allows you to look at the features side by side, which can make the decision-making process much clearer. You can see things like minimum balance requirements, monthly service fees (if any), and what kind of perks each account might offer. The aim is to help you select the one that truly fits your individual needs, much like picking the right tool for a specific job. For someone considering their financial future, like Anela Rolison, taking the time to compare these choices is a very sensible step.

Understanding the ins and outs of each account helps you make an informed choice. It is about empowering you to pick the financial product that will serve you best in your daily life. This careful selection ensures that your banking experience is not just functional, but also genuinely supportive of your financial well-being. It is about finding that perfect match that makes your money work harder for you, rather than you working harder for your money.

The Mobile App and Your Money, Chase Anela Rolison

In our busy lives, having the ability to manage your money from practically anywhere is a huge plus, wouldn't you agree? That is where a mobile app, like the Chase Mobile® app, really shines. You can download it to your phone or tablet, and suddenly, your financial world is right there in your pocket. This kind of immediate access means you can check your balance while waiting for coffee, or transfer funds while on the go. It is about fitting your banking into your life, rather than having to schedule your life around your banking.

The app is more than just a way to check your balance, too. It offers features that can genuinely help you stay organized and on track. For instance, you can easily transfer money between your accounts or send funds to others. There are also tools like autosave, which can help you set aside money automatically without even thinking about it. And if you are trying to stick to a spending plan, the budget planning features can give you a clearer picture of where your money is going. These tools are designed to make financial management feel less like a chore and more like a simple part of your routine. It is a very practical way to keep your finances in order, for anyone, perhaps even for someone with a dynamic lifestyle like Anela Rolison.

Having your money management tools available on your mobile device provides a level of freedom that was once unimaginable. It means you can respond to financial needs quickly, whether it is paying an unexpected bill or moving funds to cover a purchase. This flexibility is a significant benefit, allowing you to maintain control over your finances no matter where you are. It truly transforms how you interact with your money, making it a more fluid and responsive process.

Paying Bills and Sending Funds with Ease, Chase Anela Rolison

Let's face it, dealing with bills can sometimes feel like a never-ending task. But what if you could take away some of that hassle? With online banking and mobile apps, you can set up recurring payments for your regular bills. This means your rent, utilities, or loan payments can be sent automatically on a specific date, so you do not have to remember to do it each time. It is a very convenient way to make sure things are paid on time without the stress of remembering deadlines.

Beyond recurring payments, the ability to pay bills and transfer money without the need for physical checks or postage is a real game-changer. Think about all the time and effort saved by not having to find an envelope, write out a check, or go to the post office. All these actions can be done from your computer at chase.com or right from your mobile device. This simplifies the process immensely, giving you more time back in your day. It offers a kind of freedom from the small, repetitive tasks that can add up. For someone who values efficiency, like Anela Rolison, this streamlined approach to payments is a clear advantage.

This approach to payments is about more than just convenience; it is about security and control. By managing these transactions digitally, you have a clear record of everything, and the process is protected. It means you can send money to friends or family, or cover your monthly expenses, with just a few taps or clicks. This modern way of handling funds helps you stay organized and reduces the chances of missing a payment. It is a smart way to keep your financial life running smoothly and without unnecessary complications.

When Life Throws You a Curveball - Unexpected Chases

Now, shifting gears a little, life is not always about managing money; sometimes, it is about those unexpected pursuits, those moments when you find yourself on a different kind of "chase." The word 'surprise' can be a bit misleading here, as often these chases are not planned. For some, it is about the thrill of finding a specific train. On my hometown rail line, for example, I hardly ever just set out with a fixed plan to do a chase. It is usually a quick text message tip that gets things moving, or simply spotting a train passing through town while I am out doing other things. It is about being ready for those spontaneous moments.

These kinds of pursuits can be quite personal. There was a time, for instance, when a solo steam chase came about. As the day approached, everyone else who might have joined was either feeling unwell or could not get time off from work. So, I found myself heading out alone for my very first steam chase. It was a very bittersweet experience, you know? There was the excitement of the chase itself, but also a quiet sense of solitude. Sometimes, you just get lucky, and things align in a way you did not expect, leading to a memorable moment.

These moments of pursuit, whether planned or not, can sometimes have a wider impact. Consider the aftermath of a train incident where a wreck and the investigation that followed led to some important changes in how rail operations are conducted. It shows how even a single event can spark significant reforms, making things safer for everyone. This kind of ripple effect is pretty fascinating when you think about it. It is a testament to how specific events can shape broader practices.

And then there are the visual memories, the scenes that stick with you. Like the image of Ehoh heading west, disappearing into the sunset over the Arkansas River bridge between Amity and Barton, Colorado. Or a photograph captured by Joe Ward, showing the chase of a westbound local train returning to Lodi. These are the kinds of specific details that make a story feel real, that paint a picture in your mind. Even the details of the trains themselves, like engine 2732, which was originally numbered 5325, and was one of the few SD7s to have that experimental block SP lettering that it kept until it was no longer in service. These little bits of history add so much to the narrative of these unexpected pursuits.

So, whether it is the steady pursuit of financial well-being or the spontaneous pursuit of a passing train, life is full of different kinds of "chases." And having the right tools, whether they are banking services that simplify your money management or just an open mind for unexpected adventures, can make all the difference in how you experience these journeys.

This article has explored how Chase provides comprehensive financial services, including online account management, secure banking options with no overdraft fees, and readily available customer support. We also looked at how to choose the right checking account and the convenience offered by the Chase Mobile® app for managing money, making payments, and setting up recurring transfers. Finally, we touched upon the different, often spontaneous, pursuits in life, drawing parallels

- Hazel Renee

- Goran Visnjic

- Jackson Timothy Brundage

- Georgina Rodriguez Age Birthdate

- How Did Alison Botha Survive