It’s really something when everyday people bring important topics to light, especially when those topics affect so many lives. For a while now, folks have been talking about a particular part of our money future called the Windfall Elimination Provision, or WEP for short. And you know, a creator named Natalie has been right there, sharing insights and helping make sense of it all through her videos. Her content, like "wep natalie part 3," helps to shine a light on these things that can feel a bit tangled for many people.

This discussion about WEP and what it meant for people's retirement money has been quite a journey, and it’s actually a pretty big deal for a lot of families. When rules about how you get your social security payments change, or even when they just exist in a way that’s not totally clear, it can feel like a lot to keep up with. That’s where people who break it down, like Natalie, really come in handy, offering a way to get a grip on what’s happening.

So, as we look at "wep natalie part 3," we’re going to chat about what WEP was, how it could change someone’s future money, and what has recently happened with it. We’ll also touch on why getting information from people who are just sharing their thoughts, like on social media, can be a valuable way to stay in the loop about your money and your future plans. It’s all about making sense of what can sometimes feel like a very big puzzle.

Table of Contents

- Who is Natalie and What is wep natalie part 3 all about?

- What Was the Windfall Elimination Provision, Anyway?

- How Did WEP Affect People's Payments?

- What Changed with the Repeal of WEP?

- Why Does Getting a Grip on Your Future Money Matter?

- Are There Other Things to Know About Your Retirement Money?

- What's Next for wep natalie part 3 and Similar Discussions?

Who is Natalie and What is wep natalie part 3 all about?

You know, when we talk about "wep natalie part 3," it’s really about a person who uses social media to talk about things that matter. Natalie, known as @nataliesolomons88 on TikTok, has put out several videos that touch on a money rule called WEP. These videos, like the one titled "wep natalie part 1," seem to be part of a series where she shares information or thoughts related to this topic. It’s pretty cool how people can share these kinds of details and help others figure things out, just like that.

Her content gets a fair bit of attention, with some videos getting quite a few likes. It seems like she talks about a range of things, from the WEP discussion to personal moments. For instance, one video mentioned a "very emotional day for the family and community" and that "a month has passed and still no arrest." This suggests her content can be quite personal, offering a look into her life and the things that affect her and those around her, which is kind of what makes social media so compelling, don't you think?

So, when you hear "wep natalie part 3," it points to a part of her ongoing conversation about WEP, likely building on earlier videos. It’s a good example of how complex financial topics can find a voice on platforms where people connect in a more casual way. This approach can sometimes make these big, serious topics feel a little less scary and more approachable for everyday folks, which is definitely a good thing.

A Look at Natalie's Public Presence

Natalie, using the name @nataliesolomons88, has built a presence on TikTok, where she shares various videos. Her account shows a good number of likes, suggesting her content resonates with many viewers. It’s interesting to see how creators like her use these platforms to talk about a mix of personal experiences and public matters, like the WEP discussion in "wep natalie part 3." She has a decent following, which means a lot of people are tuning in to what she has to say. It really goes to show how influential a single person can be in sharing information.

Her videos touch on a variety of subjects, from discussions about the Windfall Elimination Provision to other everyday topics. For instance, some of her content might include things like "bush apple hat tutorial" or even mention popular culture references, like "jazz chisholm bite." This mix of topics probably helps her connect with a wider group of people, making her content feel more relatable and less like a dry lecture on finances. It’s a pretty smart way to get people to pay attention to important things, actually.

It seems that Natalie's approach involves sharing moments from her life, as well as information that might be helpful to others. The mention of an "emotional day" and the ongoing concern about an "arrest" show that her content can be quite open and personal. This kind of sharing can build a sense of community among her followers, who might feel a connection to her experiences. That connection, you know, can make people more likely to listen when she talks about something like the WEP rule.

Personal Details for wep natalie part 3

Here’s a little bit about Natalie’s public profile, based on the information provided, which helps us put "wep natalie part 3" into context:

| Detail | Information |

|---|---|

| TikTok Handle | @nataliesolomons88 |

| Total Likes (as of text) | 763.8k |

| Content Focus | Discussions on Windfall Elimination Provision (WEP), personal life updates, general interest topics. |

| Key Series Mentioned | "wep natalie part 1," "wep natalie part 3" |

| Recent Personal Note | Mention of an emotional day for family and community, and an ongoing concern about an arrest. |

This table gives you a quick look at some of the things that make up Natalie’s online presence. It helps us see that she’s a creator who touches on both public matters and personal experiences, which is pretty common for people sharing their lives online. Her discussions around WEP, like in "wep natalie part 3," are just one part of what she puts out there for people to see and think about.

What Was the Windfall Elimination Provision, Anyway?

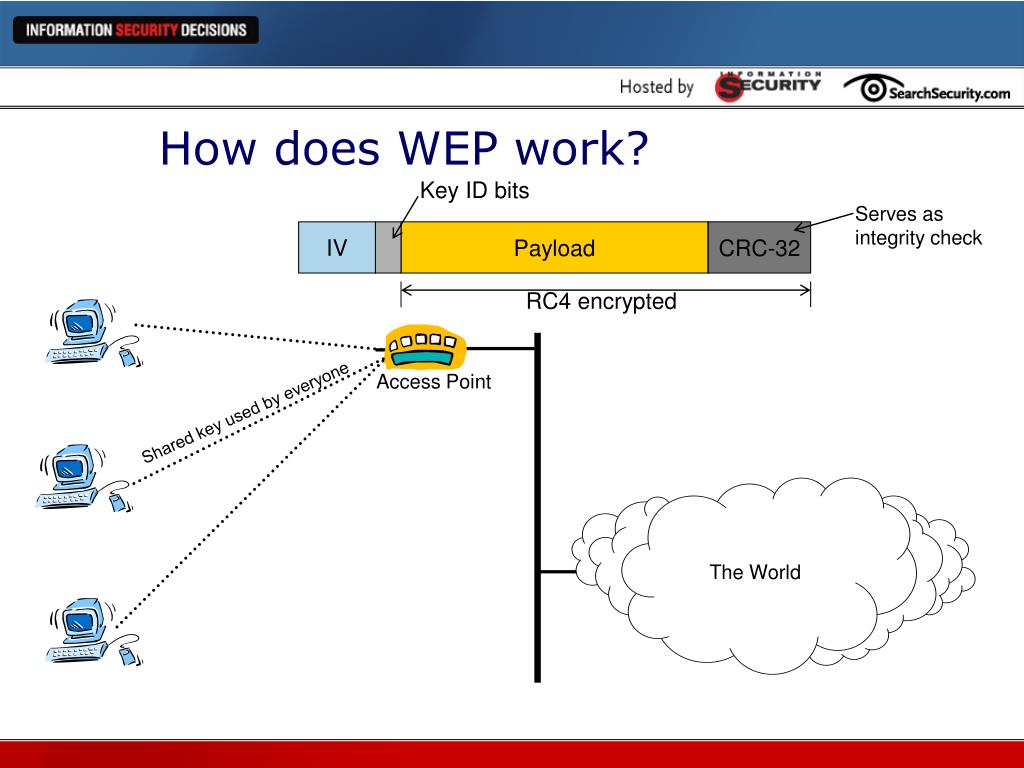

So, let's talk about the Windfall Elimination Provision, or WEP. For a long time, this was a rule that could make your Social Security retirement or disability payment a little smaller. This happened if you also got a pension from a job where you didn't pay Social Security taxes. It's a bit like this: imagine you have two different ways of earning money for when you stop working. One way, you pay into Social Security with each paycheck. The other way, you get a pension from a job that didn't take out Social Security taxes. The WEP rule, basically, tried to balance things out.

The idea behind WEP, which was put into place by Congress back in 1983, was to prevent people from getting what was seen as an unfair advantage. If you worked a job where you paid into Social Security for a good chunk of time, and then also worked another job where you got a pension but didn't pay Social Security taxes, the government worried you might get a bigger Social Security payment than someone who only paid into Social Security their whole working life. So, the WEP was a way to adjust that, making your Social Security payment a bit less, you know, if you had that other pension.

It was a formula, a set of steps, that would look at your work history and your pension from those "noncovered" jobs. These are jobs where, for whatever reason, you weren't paying FICA taxes, which are the taxes that fund Social Security and Medicare. Things like some government jobs, or certain public sector roles, might have been "noncovered." The WEP rule was meant to keep things fair across different types of work histories, which, as you can imagine, could be a bit tricky to explain to people.

This rule, the WEP, was a common topic of discussion for many years, especially for those getting close to retirement or already receiving payments. People would often try to figure out how it might affect their own money plans. That’s why discussions like "wep natalie part 3" became so helpful, as they tried to shed some light on what could be a confusing rule for many people. It was, in some respects, a rule that many felt was a bit unfair, too.

How Did WEP Affect People's Payments?

So, how did this WEP rule actually change someone's money coming in? Well, if you were eligible for Social Security payments and also getting a pension from a job that didn't have FICA taxes taken out, your Social Security payment would get smaller. It wouldn't disappear completely, but it would be less than what you might have expected if you only looked at your Social Security work history. This reduction could be a real surprise for some people who weren't aware of the rule.

It's important to remember that the WEP was a calculation. It wasn't about stopping you from getting Social Security or your pension. You could still get both. But the amount of your Social Security payment would be adjusted downwards because of that other pension. This meant that people who had worked in both "covered" (paying Social Security taxes) and "noncovered" jobs needed to pay extra attention to how their retirement money would look. It could really throw a wrench in someone's financial plans if they weren't expecting it, you know?

The impact of WEP could vary a lot from person to person. It depended on how many years you worked in jobs that paid into Social Security, and how big your "noncovered" pension was. For some, the reduction might have been a small amount, but for others, it could have been a pretty significant chunk of their expected Social Security income. This made it a topic of concern for many, and a reason why discussions, perhaps like those in "wep natalie part 3," were so valuable for people trying to get their heads around it.

Think about it this way: if you had worked for 30 years paying into Social Security, you might expect a certain amount. But if 10 of those years, or even more, were in a job that gave you a pension but didn't take out Social Security taxes, the WEP would kick in. Your Social Security payment would then be recalculated using a different, less generous formula. This could mean a few hundred dollars less each month for some people, which, for someone living on a fixed income, can be a really big deal.

What Changed with the Repeal of WEP?

Here’s the big news that many people have been waiting for: the Windfall Elimination Provision, or WEP, was actually taken away. Congress made this happen in late 2024. This is a really significant change for a lot of people who were affected by this rule. It means that the formula that used to make their Social Security payments smaller because of another pension is no longer in effect. This is, you know, pretty much what many people had hoped for over the years.

Along with WEP, another rule called the Government Pension Offset, or GPO, was also taken away. Both of these rules had the effect of reducing or even stopping Social Security payments for a good number of people, over 2.8 million folks, actually. So, getting rid of both WEP and GPO is a huge relief for those individuals and their families. It means that their Social Security payments will now be figured out without those reductions, which is a pretty big win for them.

A recent federal law now makes sure that your pension from a job where you didn't pay FICA taxes won't change your Social Security payment. This is a very clear statement that the old way of doing things is gone. It means that you can get both your pension and your Social Security payment, and one won't affect the size of the other. This provides a lot more certainty for people planning their retirement money, and it takes away a source of worry that many had for a long time. It’s a definite shift in how things work, and it's something that many people will be very happy about.

This change is something that people like Natalie, through discussions such as "wep natalie part 3," might have been talking about or hoping for. It shows that even complex government rules can change over time, especially when there's a lot of public discussion and advocacy around them. For those who were worried about WEP, this news offers a much clearer path forward for their future money. It's a testament to how public conversations, even on social media, can bring about important shifts.

Why Does Getting a Grip on Your Future Money Matter?

Figuring out your money for later in life, like when you stop working, is really important. Changes happen all the time, whether it's how much you get from Social Security or what you pay for things like Medicare. Staying informed about these shifts can make a real difference in how comfortable you are down the road. It’s not just about big rules like WEP; it’s also about smaller, regular adjustments that happen every year. So, keeping an eye on these things is just plain smart, you know?

The Social Security Administration, or SSA, regularly looks at your payments each year. They check your recent work records and how much you've earned. This is how they make sure your payments are correct and up-to-date. Knowing how the SSA figures out your payments, and what might cause them to change, gives you a better sense of what to expect. It helps you plan and feel more in control of your money future. It’s pretty much like checking the weather before you head out; you want to be prepared.

When people share information, like what Natalie does with "wep natalie part 3," it helps others get a better grip on these important topics. Not everyone has the time or the inclination to read through lots of government documents. So, having someone break it down in a more friendly, easy-to-understand way can be incredibly helpful. It makes the information more approachable and less intimidating, which is exactly what people need when they’re thinking about their future money. It’s about feeling ready for what’s ahead.

Thinking about your retirement money isn't just for older folks; it’s something to consider at any age. The sooner you start to understand how these systems work, the better prepared you'll be. Knowing about things like how Social Security payments are calculated, or what different rules might have meant, helps you make good choices for yourself. It’s all about building a solid foundation for your later years, and that really starts with knowing what’s what. It’s a bit like putting together a puzzle, where each piece of information helps you see the full picture.

Are There Other Things to Know About Your Retirement Money?

Beyond the WEP rule, there are always other things to keep an eye on when it comes to your retirement money. For instance, the general rules for Social Security payments can shift a little bit each year. These changes might include things like the maximum amount of earnings that are subject to Social Security taxes, or cost-of-living adjustments that help your payments keep up with prices. It’s a pretty dynamic area, so staying a little bit informed is always a good idea.

Medicare costs are another big piece of the puzzle for many people. These costs can also change from year to year, affecting how much you pay for health care once you're older. Knowing what to expect with Medicare premiums, deductibles, and other expenses is just as important as knowing about your Social Security income. It’s all part of the larger picture of your financial well-being in retirement. You really want to have a good handle on both sides of the coin: what’s coming in and what’s going out.

The Social Security Administration has a process where they regularly look at your benefits. This process makes sure that your payments reflect your most recent work records and earnings. So, if you continue to work, your payments might be adjusted upwards based on those new earnings. It’s a system that tries to keep up with your life and work history, which is pretty fair, you know? They want to make sure you get what you’re owed based on your contributions.

Learning more about how the SSA figures out your benefits can be really helpful. Their website has lots of information, and sometimes, a simple call can clear up many questions. The more you know, the better you can plan. It’s not about being an expert, but just having a general idea of how these systems work can give you a lot of peace of mind. It's like having a map for your financial future, helping you see where you're going and what might be along the way.

What's Next for wep natalie part 3 and Similar Discussions?

With the WEP rule now taken away, the conversation around "wep natalie part 3" and similar topics might shift a little. Instead of focusing on how to deal with the reduction, discussions might now turn to what this change means for people who were affected, and how their payments will now look. It’s a good opportunity for creators like Natalie to continue sharing updates and helping people understand the new reality. It’s a bit like closing one chapter and opening another, you know?

The fact that a federal law now makes sure pensions won't change your Social Security payment is a pretty clear signal. It simplifies things for a lot of people. This kind of clear information is what people really appreciate, especially when it comes to their money. It takes away a layer of worry and makes planning for the future feel a lot more straightforward. That’s something to celebrate, honestly.

Discussions on social media, like those from @nataliesolomons88, play a pretty important role in getting this kind of information out there. Not everyone follows political changes or financial news closely. But when someone they follow talks about it in a way that makes sense, it helps spread awareness. It’s a powerful way to keep communities informed and connected, especially on topics that touch so many lives. It’s pretty cool how that works, actually.

So, as we move forward, we can expect more conversations about how these changes affect individuals, perhaps with personal stories or examples. The goal remains the same: helping people get a better grip on their money future. Whether it’s through official government channels or through friendly faces on social media, having access to clear, helpful information is always a plus. It helps everyone feel a little more secure about what’s ahead, which is really what it’s all about.

This whole conversation, from understanding what WEP was to seeing it go away, shows how much things can change for our future money. It’s a reminder that rules about Social Security and pensions are always being looked at and sometimes adjusted. People like Natalie, through her "wep natalie part 3" content and other videos, help make these often-complicated topics a bit easier to follow. Her public presence, including those more personal moments she shares, helps build a connection that makes learning about these things feel more natural. The big news, of course, is that the Windfall Elimination Provision and the Government Pension Offset are no longer around, which means a lot for many people's retirement payments. This change means that getting a pension from a job where you didn't pay Social Security taxes won't make your Social Security payment smaller anymore. It’s a pretty significant shift that simplifies things for a good number of folks looking ahead to their retirement years. Staying informed about these kinds of changes, whether big or small, is always a good idea for your money future, and it’s something that people are always trying to figure out.